Netspend Explained: Your Guide To Prepaid Debit & Financial Freedom

Table of Contents:

- Understanding Netspend: A Gateway to Financial Alternatives

- What Exactly is Netspend? A Core Definition

- Why Netspend? Addressing the Needs of the Unbanked and Underbanked

- How Does Netspend Work? Simplicity in Action

- Key Features and Benefits of Netspend

- The Netspend Savings Account: A Closer Look at the 5% APY

- Navigating Netspend Fees: What You Need to Know

- Security and Trust: Is Netspend a Reliable Choice?

- Who Can Benefit Most from Netspend?

- Conclusion: Is Netspend the Right Financial Tool for You?

Understanding Netspend: A Gateway to Financial Alternatives

Have you ever found yourself wondering, "What is Netspend?" Perhaps you've seen it advertised on television, or a friend has mentioned it as a convenient financial solution. In an increasingly digital world, access to reliable payment systems is paramount, yet traditional banking isn't always accessible or preferred by everyone. This is precisely where Netspend steps in, offering a robust alternative to conventional bank accounts and credit cards.

Netspend has emerged as a prominent player in the U.S. financial landscape, providing prepaid debit card services and payment solutions since its inception in 1999. It's designed to empower individuals with the ability to manage their money, make purchases, and pay bills without the need for a traditional bank account or a credit check. This comprehensive guide will delve deep into everything Netspend offers, helping you understand its features, benefits, and whether it's the right financial tool for your needs.

What Exactly is Netspend? A Core Definition

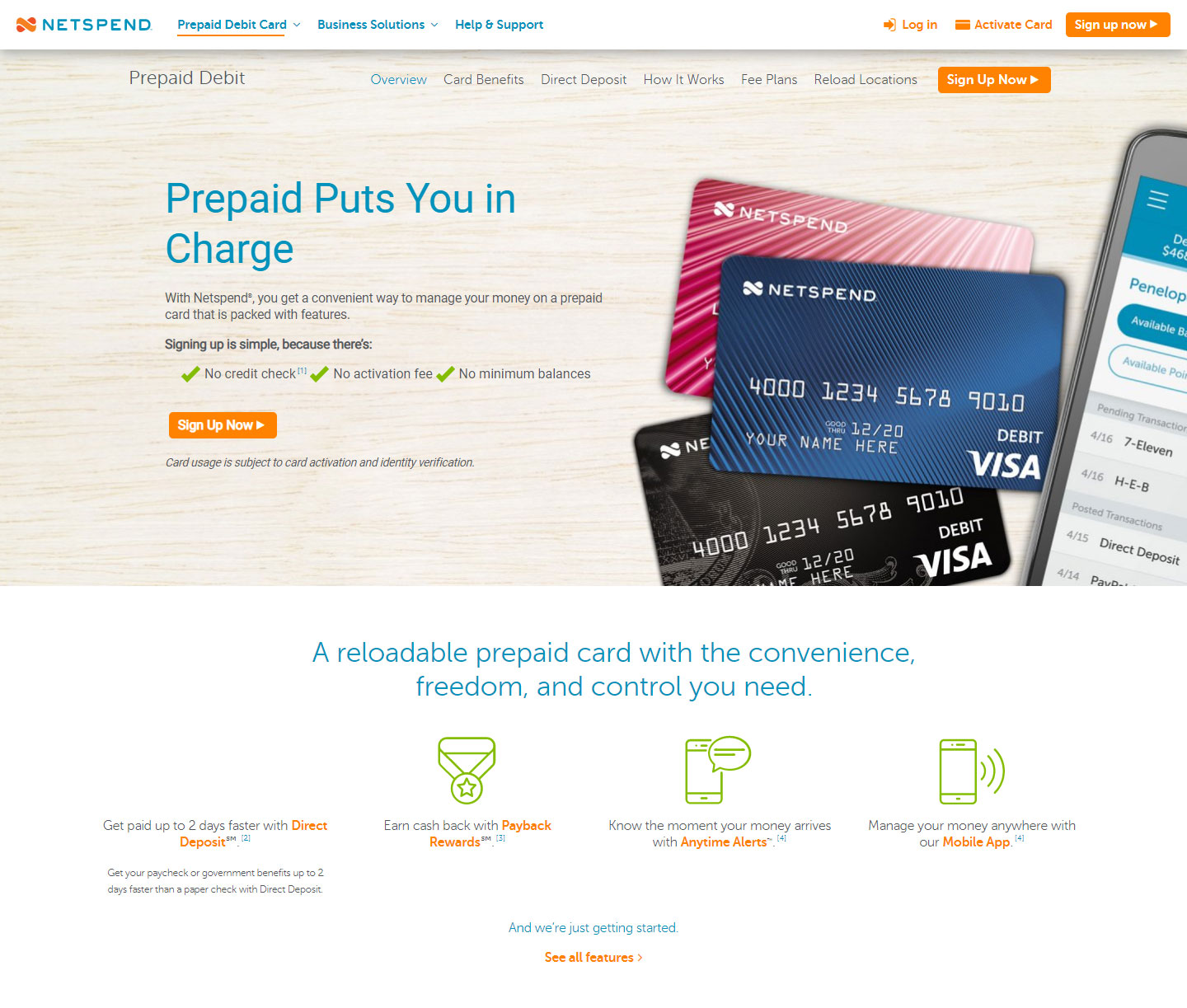

At its core, Netspend is a financial services company that specializes in prepaid debit cards. Founded in 1999 and headquartered in Austin, Texas, it has established itself as a leader in providing alternative banking solutions in the United States. Unlike traditional debit cards linked to a checking account or credit cards that rely on a credit line, a Netspend card is a prepaid debit card. This means you load money onto the card, and you can then use that money for purchases, bill payments, and ATM withdrawals, much like a regular Visa or Mastercard debit card.

The beauty of the Netspend system lies in its simplicity and accessibility. It operates on a "deposit money, then use it" principle. Once the funds you've loaded are depleted, you have the option to reload the card with more money or simply discard it. This makes Netspend an incredibly flexible and straightforward payment method, particularly appealing to individuals who may not have access to traditional banking services or who prefer a more direct, pay-as-you-go approach to managing their finances. It's a payment system that allows you to use a prepaid card without needing a credit history or verification, functioning as a true alternative to traditional debit or credit cards.

Why Netspend? Addressing the Needs of the Unbanked and Underbanked

One of Netspend's most significant contributions is its role in serving the unbanked and underbanked populations. For millions of people in the United States, traditional banking services — with their requirements for credit checks, minimum balances, and sometimes complex fee structures — can be a barrier. Netspend provides a viable and often essential alternative. With a Netspend card, you don't need a minimum balance or a credit check to get started. This opens up financial access to a broader demographic, including:

- Individuals without

- Mark Fluent

- Sotwe

- Aishah Erome

- %C3%A3%C6%92 %C3%A3%C6%92%C3%A3%C3%A3%C6%92%C3%A3%C6%92%CB%86%C3%A3%C6%92%C3%A3%C6%92

- Deformed Dog

Prepaid Debit Cards | Business Prepaid Cards | Netspend

![17 Best Virtual Card Providers for Business Spending [2025]](https://geekflare.com/wp-content/uploads/2024/06/netspend-logo.jpg)

17 Best Virtual Card Providers for Business Spending [2025]

Netspend Login – Sign In to Netspend Prepaid Account